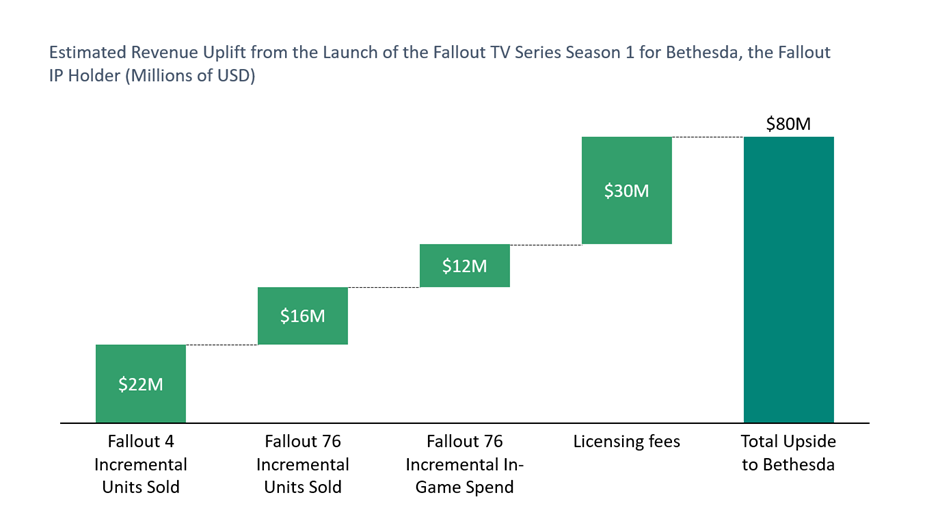

TLDR: The Fallout TV series made Bethesda an estimated 80 million dollars in game-related revenue and license fees with just one season. The TV show revitalised interest towards the franchise, boosting game sales and in-game spend. The potential lifetime value of this to Bethesda, the Fallout IP holder, is hundreds of millions of dollars.

Transmedia is a growing trend in the games industry, though it’s not a new concept. Companies like Disney have long used it, spreading their IP across films, TV shows, comics, toys, theme parks, and video games. Essentially, transmedia maximizes IP value by expanding into new platforms and formats, attracting new fans, and engaging existing ones.

Common types of transmedia involving video games

Book to Game

Some amazing games began as books. The Witcher series, starting as a book by a Polish author, found its first global audience through video games and then expanded further with a popular TV show. The Lord of the Rings and Harry Potter also started as books, moved to TV, and then became games.

Rationale: Some book worlds are so detailed that they can quite naturally be transitioned to games. From a commercial perspective, leveraging an existing fan base mitigates downside risk and there is upside potential to expanding the IP to new audiences.

TV to Game

Another successful example of franchise expansion has been existing TV franchises licensing the IP to video games. Disney has some of the earliest examples of that through Mickey Mouse, but also some of the more recent ones through licensing Marvel and Star Wars IPs.

Rationale: Creating games based on existing TV IPs is unlikely to reach many new audiences. However, it offers an attractive additional monetization mechanism for the IPs targeting younger audiences who are often gamers anyway.

Game to TV

Historically, expanding game IPs to TV has been less successful. Even five years ago, many believed it didn’t work because games are niche, with hardcore audiences, and their interactive nature is hard to translate to film. Examples of failed attempts include Max Payne, Warcraft, Gran Turismo, and Assassin’s Creed, which had potential but fell short commercially and critically.

However, the last 5 years has seen successful transmedia examples. The Last of Us was a masterpiece, loved by critics and audiences alike. Nintendo IPs like the Super Mario Bros Movie and Pokémon Detective Pikachu were commercial hits. Both Dota and League of Legends have released successful anime TV series. Most recently, the Fallout game franchise’s TV series on Amazon was a major success and positively impacted the games.

Rationale: A successful TV show can re-engage existing players (useful for live service games) and expand the market of interested people, offering significant upside for the IP holder by boosting player engagement and attracting new audiences.

The Success of the Fallout TV Series

Firstly, it is important to understand that Bethesda, the game’s IP owner and Amazon, the producer and TV streaming platform owner, are two separate entities that benefit from this TV show in very different ways.

Impact of the Fallout TV series to Amazon

The impact on Amazon is clearer and easier to capitalize on. TV streaming services release content to attract new audiences and retain existing ones. While retaining viewers often means providing a lot of content, attracting new audiences requires big hits like the Fallout TV series.

Here’s what we know about the Fallout TV show viewership:

- 65M viewers in the first 2 weeks – The Fallout TV show is Amazon’s second most-watched TV show ever, only behind The Lord of the Rings: The Rings of Power.

- Mostly watched by 18-34 year olds – Important as Amazon aims to reach new, younger audiences.

- 60% of the audience from outside of US – Beneficial for expanding Amazon’s primarily US-heavy audience.

It’s clearly been successful for Amazon, even if we can’t put exact revenue or profit numbers to it. What about Bethesda, the IP owner?

Impact of the Fallout TV series to Bethesda

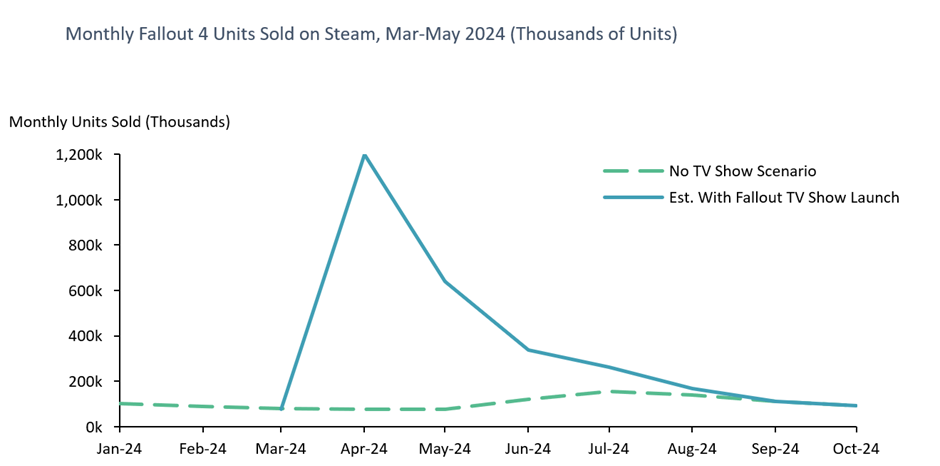

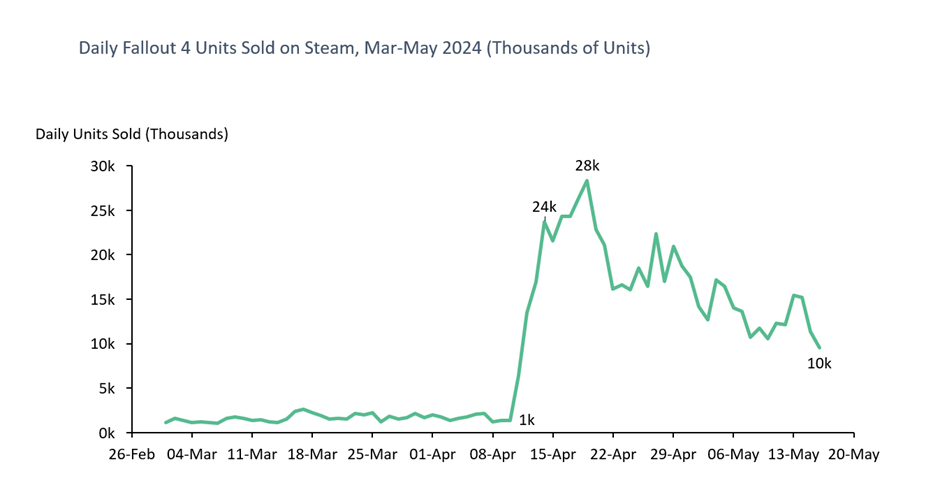

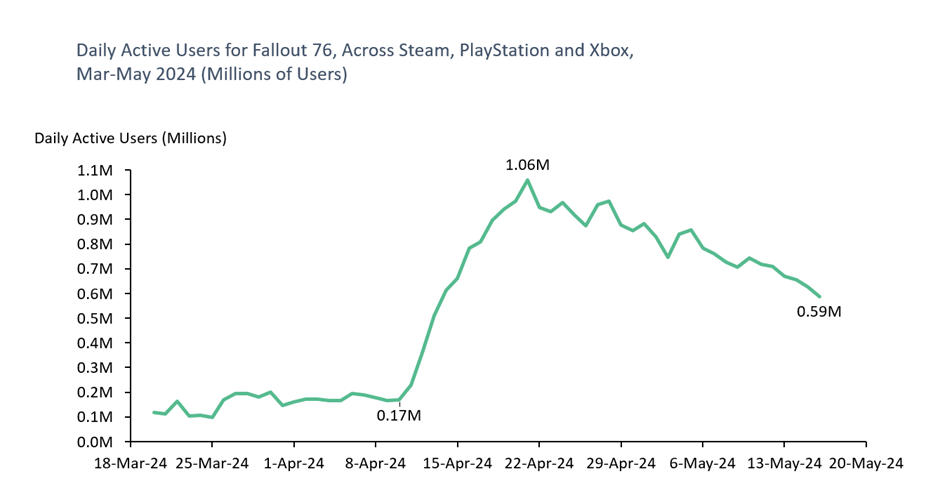

Methodology – Each of the revenue opportunities for Bethesda is calculated by analysing the uplift in Fallout game metrics at the time of the TV show’s launch and forecasting the trend forward to September, when we estimate most of the upside has been realized. We have only considered the impact to Fallout 4 and Fallout 76 here. We don’t cover Fallout Shelter as we lack the data behind it, so we’re likely underestimating the total impact by c. $5-10M. There is additional upside from other games, but at much lower magnitudes. The metrics are estimated using data from the Video Game Insights platform. For Fallout 4 units sold, it looks like this:

Cost – Bethesda likely incurred very little expense, as Amazon probably covered most of the marketing, production, and distribution costs. This means the revenue uplift for Bethesda is almost pure upside.

There are four main revenue uplifts to consider:

- Increased game sales – Renewed interest in the franchise boosted sales of existing games.

- More in-game revenue – Increased active players for live service games, including both new players and reengaged former players.

- Licensing fees – Bethesda was likely paid substantial fees for the right to use the IP.

- Expanded audience base – A larger audience base for future game releases.

Here’s what we think the value of each of these buckets looks like:

Increased game sales – We estimate that the TV show will generate an incremental c. 2M Fallout 4 game units sold and c. 1-1.5M Fallout 76 units. That’s roughly $35-40M in revenues post platform fees (taking promotional discounts into account).

Higher in-game spend in Fallout 76 – Daily active users of FO76 increased from c. 100-200k pre show to peaking at 1M DAU during the show’s launch window across all game’s platforms. This will likely slightly dilute the average revenue per daily active used (ARPDAU) as the new players tend to be more casual. We estimate the increased engagement from old and new players to deliver c. $10-15M in incremental in-game revenues for FO76.

Licensing fees – It is very hard to put a price to that without knowing the details, but typical game and physical goods IP license fees tend to be c. 10-20% of the revenue generated. We also know that Amazon bought the global rights of the Lord of the Rings for $250M or c. 25% of the 1st Season’s budget. Given the $150M budget for the Fallout TV show, it’s not unreasonable to assume c. 20% of the budget was on IP licensing. That would give Bethesda a c. $30M licensing fee.

Overall, the total value from Season 1 of the show that Bethesda will get is likely c. $80 million.

Is $80 million good?

You might think this is a stupid question. However, we’re talking about Bethesda (acquired for $7.5bn), a company that is owned by Microsoft ($200bn annual revenue). In this scale, $80M means a 0.05% uplift to Microsoft revenues, which is ridiculous to think about.

Perhaps that’s not the right comparison though. Let’s compare this to a major AAA game launch like Fallout 4. Fallout 4 sold over $750M worth of games in its first day and we estimate the lifetime earnings have been closer to $1.5bn across all platforms. That’s not atypical for a major AAA title. In this context, the Season 1 revenue uplift of c. $80M to Bethesda is c. 5% of total game sales, still relatively small.

However, this analysis doesn’t consider several factors.

- Firstly, we’re only assessing the impact of Season 1. Fallout TV series has already announced Season 2 and it’s likely there will be more to come. So, the impact can be many times that.

- Secondly, the series brings a much bigger total addressable audience for future Fallout games. The jury is still out on the actual financial impact of this. However, we bet that Fallout 5 (or 6 or whatever we’ll call it) is going to be planned around one of the Fallout TV show seasons launches.

We estimate that the full value of the Fallout TV series to Bethesda is in hundreds of millions in extra revenue. Importantly, this is a very low risk, low-cost revenue uplift opportunity.

Importance of a well-planned content schedule post TV launch

Bethesda did support the TV show launch with a new patch on PC, Xbox and PlayStation versions of Fallout 4. However, as far as new content goes, it’s really quite little. You could have imagined Bethesda aligning the TV show launch with a major downloadable content (DLC) or, better yet, a new game launch. Fallout 4, the last major single player title in the franchise is almost 10 years old, after all. No doubt they will be doing more to align content with next seasons now that they’ve seen the positive reception.

Transmedia – another buzzword or a real opportunity?

Hater’s gonna hate and hypers gonna hype. Cross-media opportunities provide a low-risk way for game IP holders to boost revenue, though the upside seems capped even in the most successful cases.

We predict many game IPs will be adapted for film and TV in the coming years. With slower growth in the games industry, executive teams will find these opportunities too attractive to ignore.