Steam has been hitting records across many metrics as we’re entering the holiday period. Full Game revenue for 2023 has already beat last year’s and we’ve still got a busy month ahead.

Black Friday performance is no exception. A year of strong game releases tied to unprecedented attractive promo deals has pushed 2023 Black Friday to highest units sold ever.

You can download the full report as a PDF here: VGI-2023-Black-Friday-Report

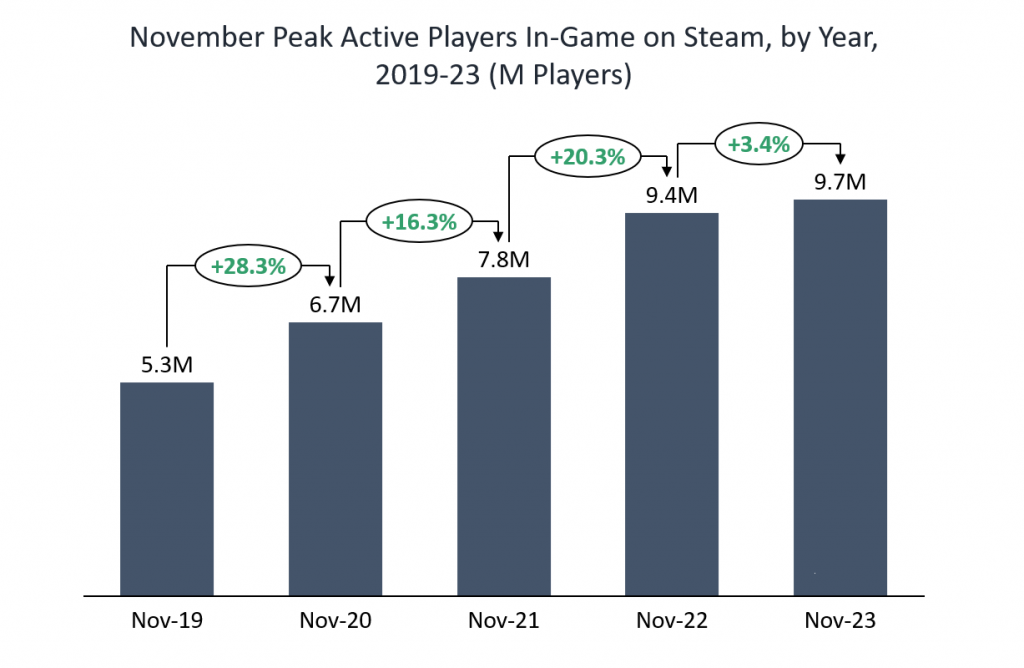

User engagement keeps breaking records on Steam despite the post-covid normalization

Covid helped to boost the whole games industry with people stuck inside and nothing better to do. New people picked up gaming as a hobby and old gamers had more time to game. The post-covid world has been tough for the games industry – years of growth that culminated with a peak in 2020 have turned to stagnation and even decline.

The exception to this has been the PC gaming space where Steam has continued to hit new record levels of engagement. Peak active users have continued to push past the Covid peak of April 2020.

The Black Fridays are no exception – 2023 November saw another record in terms of peak active players in-game on Steam.

However, this growth in engagement has clearly slowed. In fact, 2023 November peak was only 3.4% higher than last year’s.

At least partly, availability of the next generation of consoles can be blamed for this slowdown. It’s been 3 years since PlayStation 5 and Xbox X were released, but it wasn’t till 2023 that the supply really started to catch up with the demand. People who had to substitute their preferred console for PC are now able to return to… well, let’s be serious – to PlayStation.

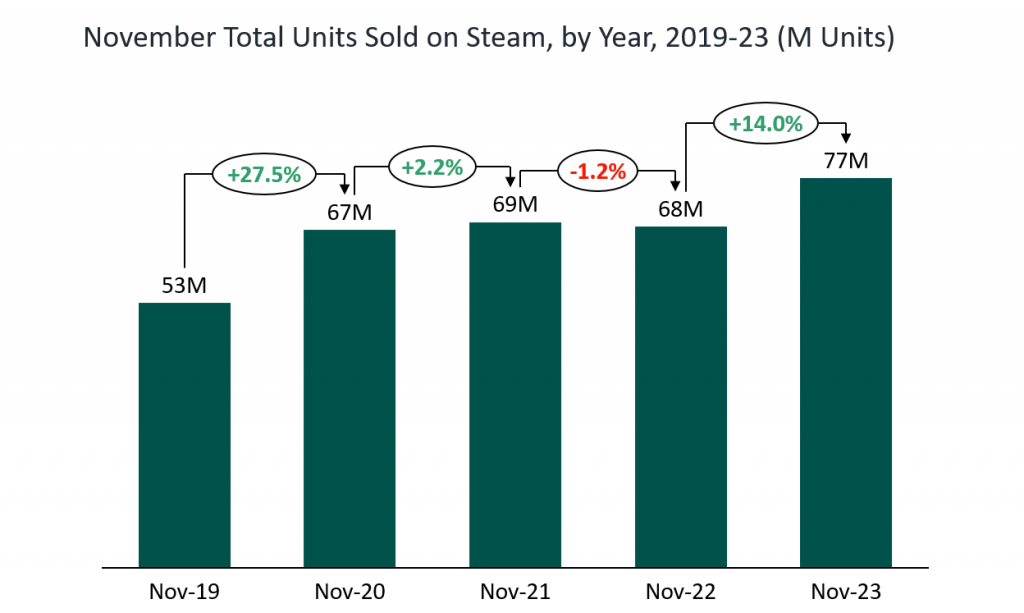

2023 is a year of significant growth after the stagnating Black Friday sales on Steam in 2021-22

Even though engagement continued strong on Steam, units sold have stagnated since 2020. Players had a large library of existing games to play and new releases were underwhelming or delayed.

2023 broke that with a strong release slate. While some of these anticipated releases underperformed expectations (Starfield, anyone?), others beat even the wildest of predictions (Baldur’s Gate 3).

This has resulted in the strongest ever Black Friday sales on Steam, beating 2022 by 14%.

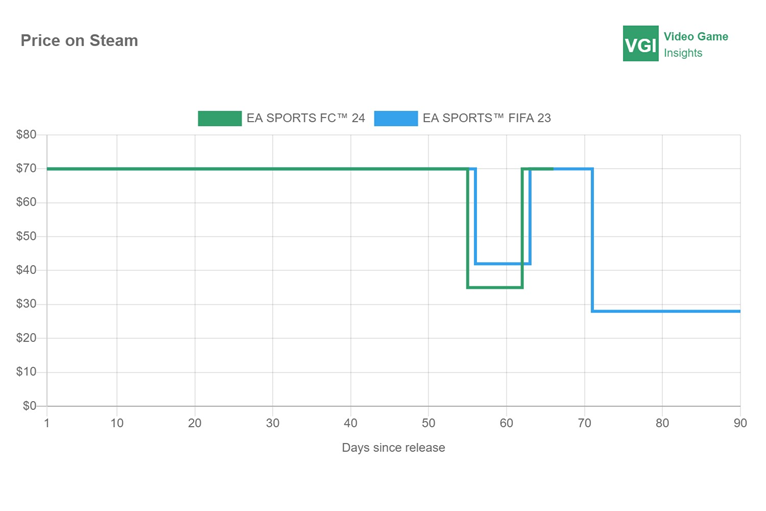

Deeper discounts were the first tool to be used by publishers in the fight for limited attention

2023 has been a tough year for many publishers as the market is getting increasingly saturated and new player growth has slowed. A natural response to that has been discounting more to boost visibility and discoverability.

EA Sports FC was on 50% sale across all platforms less than 2 months after release – the steepest ever promo for them.

Other big name 2023 releases have also gone as far as 40% off less than a year since release. Although not atypical for large titles, the amount of discounted big releases still played a role during the Black Friday.

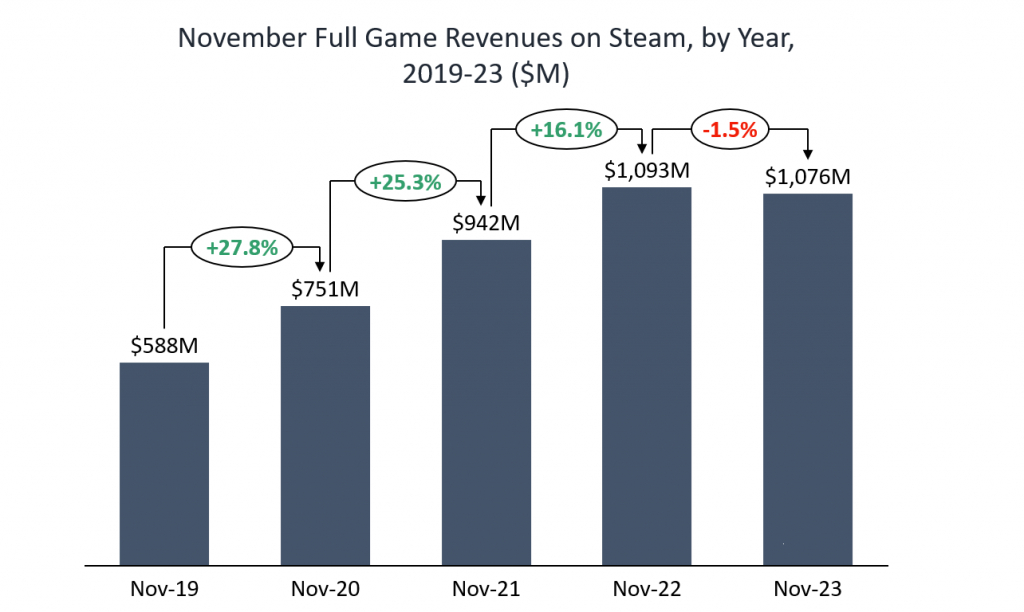

Slightly declining Black Friday revenue is a sign of fiercer competition among publishers for an increasingly fixed size of the pie

Higher engagement and record units sold failed to translate into higher revenues during Black Friday.

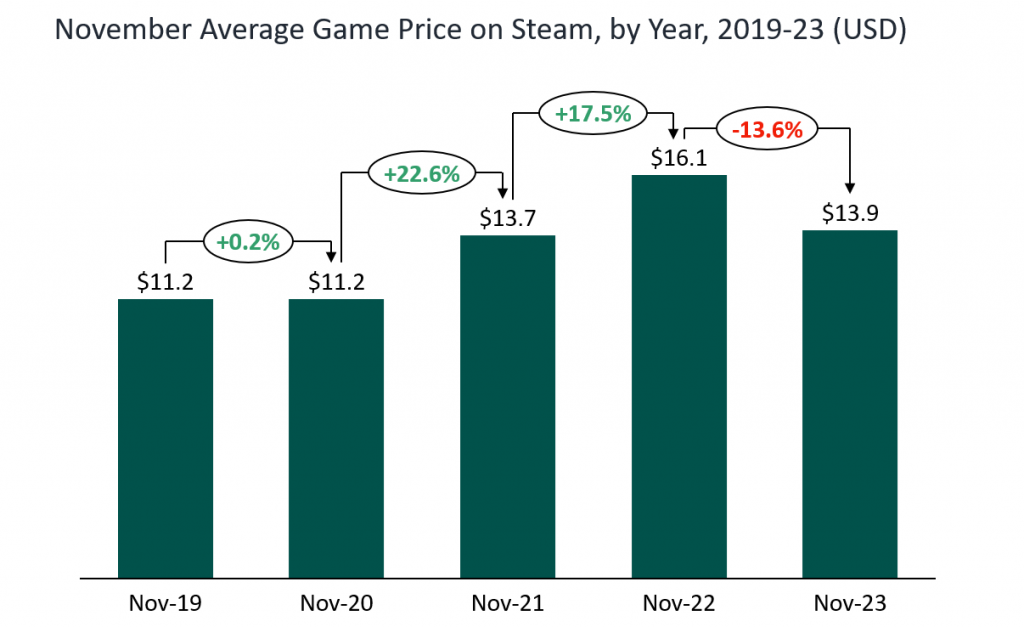

In fact, while units were up +14% YoY, full game revenue was down -1.5%. This was largely driven by steeper than usual discounts boosting units, but at lower average selling price. Players’ overall lower disposable income this year and higher competition between games due to strong releases has led to a push to the bottom as publishers are fighting for attention

Price pressure likely to continue as the games industry is facing increased supply and peaking demand

The decline in average game selling price is likely to continue as several games industry dynamics push the prices to the same direction:

- Subscription platforms such as Xbox Game Pass are likely to continue to offer great value for money in the coming years with many day 1 releases appearing free on the platforms

- Economic downturn is affecting consumers’ disposable income, leading to a decrease in spending on non-essential items, including video games. Publishers are already responding by offering more discounts to maintain sales volume

- Slowdown in gamer growth is a global trend as Covid pulled many gamers to be forward. The markets that continue to grow tend to be more price sensitive. The new users that aren’t already gamers tend to be more casual, also pushing down spend

- Increased competition between publishers on the ultra-premium games side. Many AAA publishers have adapted the same strategy of fewer, but higher quality games released

- Lower costs on indie studios through easy-to-use game engines like Unreal Engine 5 and AI support in asset creation helps small teams to create increasingly complex games, increasing the overall supply of good quality games

- Longer and more replayable games have been a trend for many years now. However, the evergreen nature of some of these games is creating a dynamic not seen in the games industry before where new releases compete for attention with games that are over 10 years old

The pressure to discount sooner and deeper will be good for gamers in the short term. However, the increased pressure on studio margins will likely result in more redundancies, streamlining and efficiency, which ultimately might not be the right formula for best games.