We are kicking off 2026 with a foundational update to the platform – significantly improving the precision of our Steam data and introducing a new layer of geographical depth to our analytics.

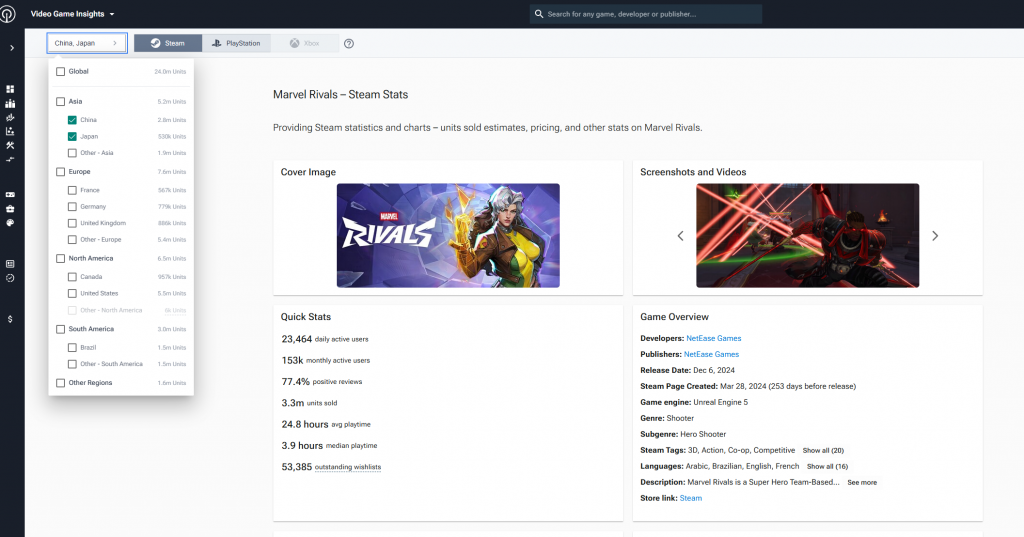

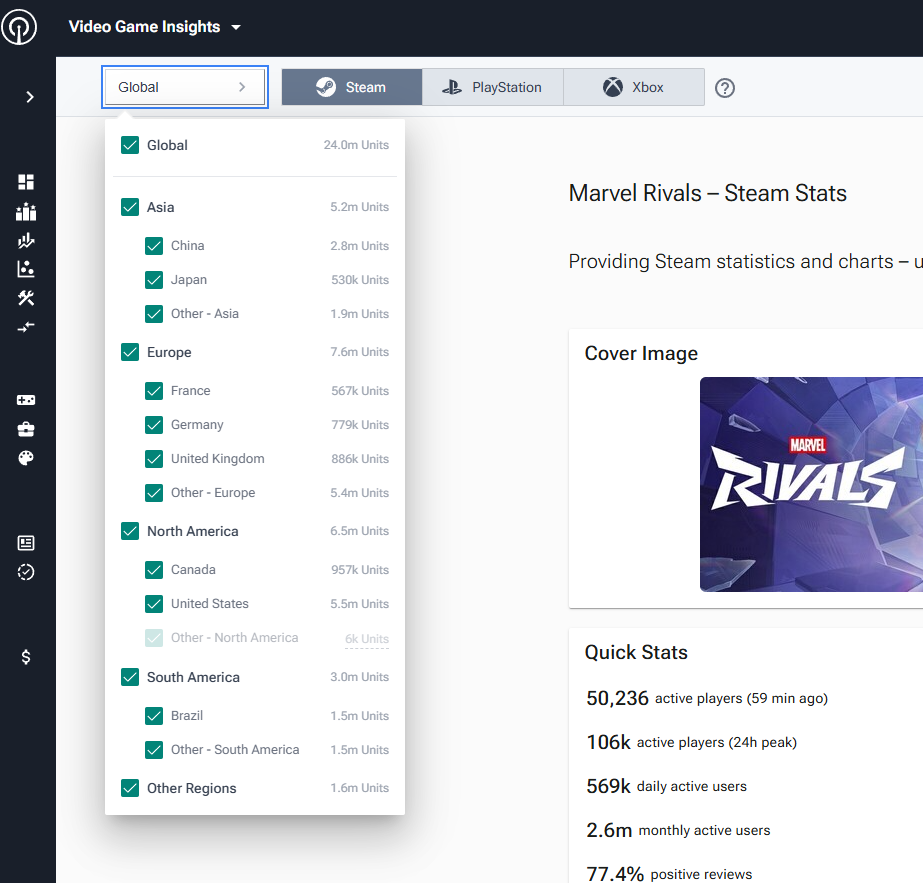

New Feature – Country Level Time Series

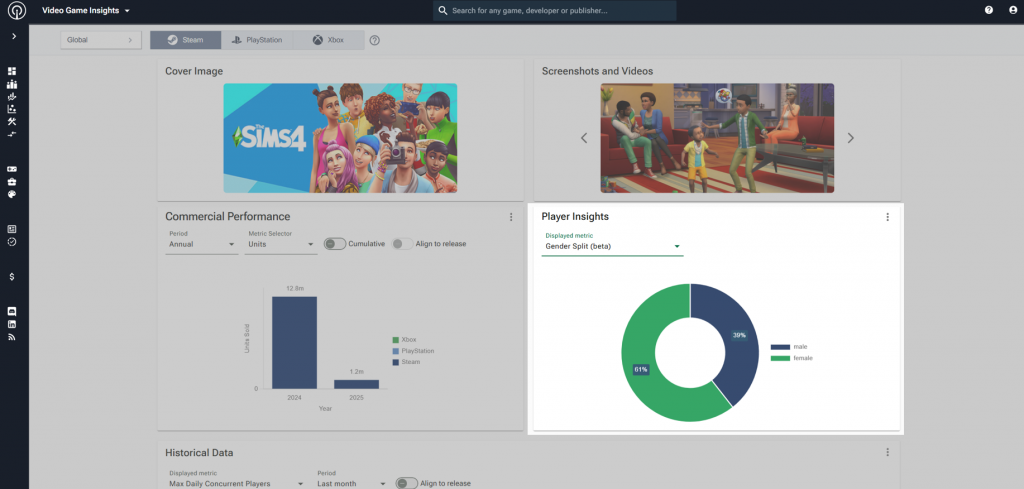

We have launched a powerful new capability on the platform – Country Level Time Series. Users are now able to filter individual game pages by specific countries or regional groups to view performance trends over time, rather than just static snapshots.

Eligibility: All games are able to have country-level data; however, the minimum units needed to select a country is 25,000 units sold for that specific country or region.

This moves our analytics beyond Global averages, allowing you to validate regional launch strategies, track retention spikes in specific markets, and analyze localized commercial performance with unprecedented detail.

What changes on the charts? When a country filter is applied, the Quick Stats, Commercial Performance and Historical Data graphs dynamically recalculate. You can now view Daily Estimated Units Sold, Cumulative Units Sold, Outstanding Wishlists, Playtime & Revenue Analysis, specifically for that region or country.

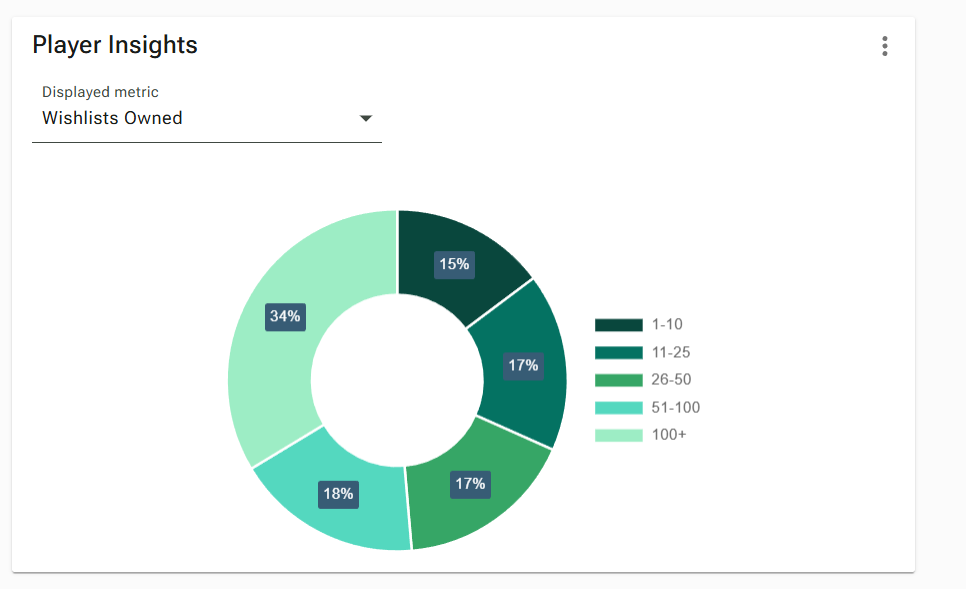

Additionally, Player Insights (such as “Players by Country” and “Wishlists by Country”) now re-baseline to represent 100% of the selected region. This gives you the exact percentage split for that specific geography, for example, isolating the market share of China vs. Japan vs Other Asia within an “Asia” filter.

Platform availability These features are currently available for only Steam and PlayStation data.

Updated Steam data accuracy

We are released a large update to the VGI platform on January 10th, 2026, which significantly improved our Steam platform estimation accuracy.

Note that historical Steam data for most games has been impacted by this update!

We encourage all API users to refresh the historical data they pull from the platform to ensure consistency in estimation methodologies.

What changed? The 5 key metrics that were impacted are units sold, revenue, DAU, MAU and wishlist estimates. While all data saw slight changes, the impact varies by metric and release date:

- DAU & MAU – The algorithm has been tweaked to be a bit lower historically. All DAU & MAU will be c. 8% lower pre May 2025.

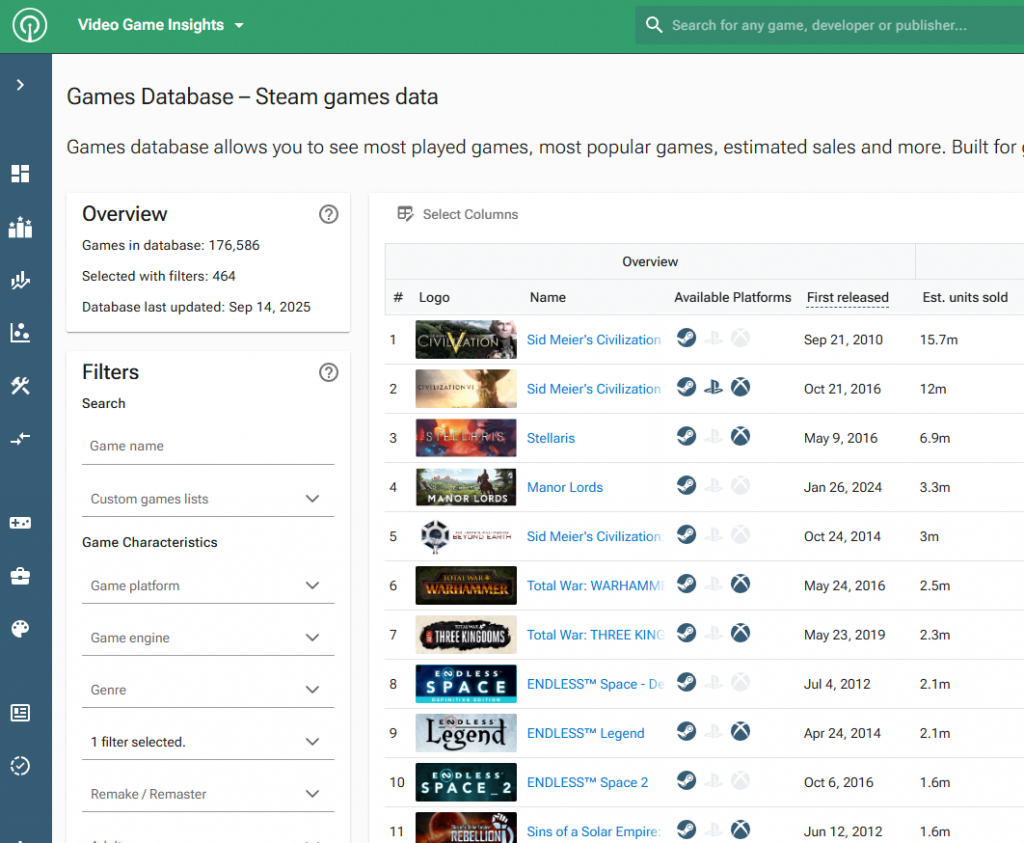

- Units Sold – We’re giving the full weight to the profile based estimates for games released post March 2024. Previously some of the units still included review based estimation weighting. No change to pre March 2024 games.

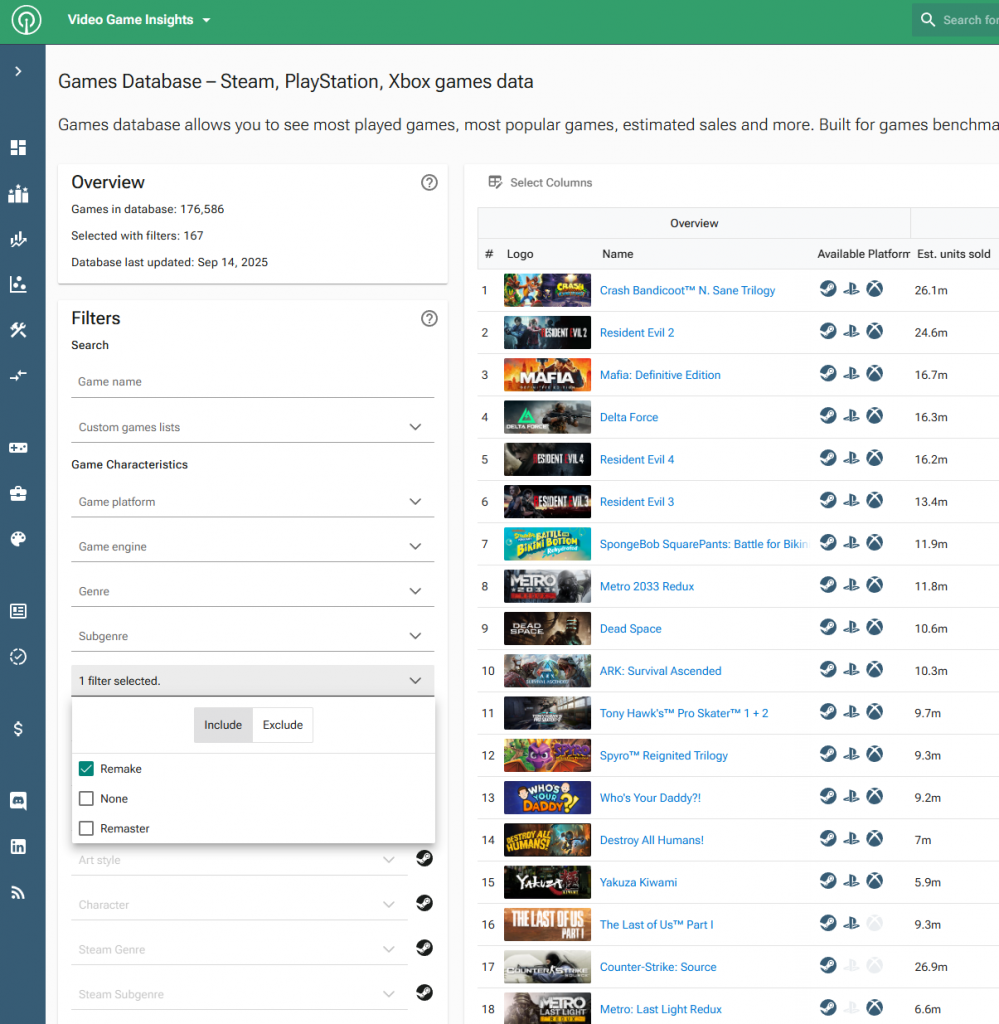

- Wishlists – Minor tweaks to sample size itself – we’re leaving out some unrepresentative accounts.

Why the change? This is part of our continuous effort to improve our estimation accuracy. In our tests, we noticed accuracy for newer games on Steam slipping and have tackled that in this update.