This article was written by the Video Game Insights team – a free video game market research and analytics platform.

What is the games industry?

Games industry is a huge and fast growing sector with a widening ecosystem. It’s no longer just about development and distribution of video games.

eSports has become a billion dollar industry on its own and bound to grow way past that. Professional teams have superstar statuses much like top footballers or tennis players.

Video game streaming has become incredebly popular for the generation Z. Limelight suggests that the 18-25 year olds now spend more time watching people play video games than watching traditional sports.

Cloud gaming platforms are the next battleground for the likes of Microsoft, Amazon and Google. That’s a whole other industry section that hardly existed a couple of years ago.

NFTs and Metaverse are recent buzzwords that surround the games industry. In reality, collectables and social gathering places have been in games for decades. These are just new fancy words (and somewhat new technologies) used on old concepts. Time will tell how imprtant part these will play.

How to think about games market research?

For the purpose of this article, we’ll cover traditional video games market, not including streaming, eSports etc.

As with any market, the size of the market only tells so much. Segmentation of that size and trends is what provides most value.

Traditional segmentations also work in games industry:

- Geography

- Revenue distribution within the value chain

- Size of the companies

- Platform

- Monetisation model

On top of that, more granular game industry specific segmentations apply:

- Genre of the game

- Type of player

- Other micro segments like art style, multiplayer vs single player, game themes etc

We’ll briefly cover each of the segmentation methods below.

How to segment the video game industry

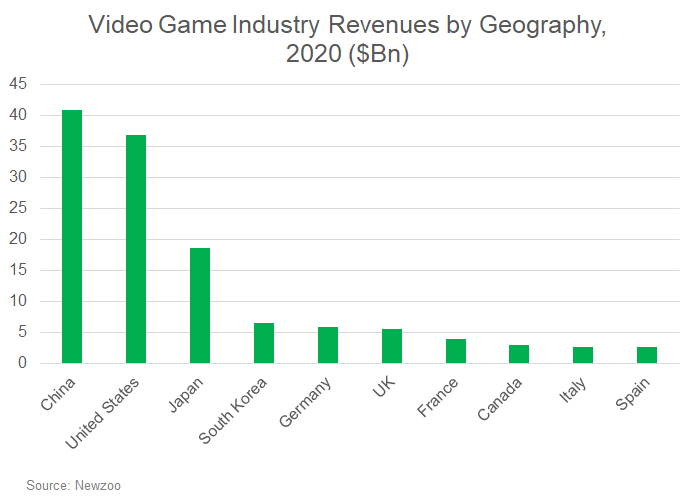

1. Games industry size by geography

Video games globally are ever more dominated by Asia as a region. China is now the #1 country by revenue with almost £41bn according to Newzoo. That’s followed by USA, Japan, South Korea and only then Germany, UK and France.

Looking at future growth, Asia is bound to continue growing its importance in video games, driven by social acceptance of gaming as a pastime as well as large middle class population.

2. Revenue distribution within the gaming ecosystem

Developers don’t get all of the $60 from selling a copy of the new game. In fact, often they don’t even get half of it.

In console, PC and mobile games alike, the important part of the valeu chain is the store platform – from Steam to Google Play to Playstation Store. They typically take 12-30% of the revenues, mostly on the higher end.

Publishers are another important, but somewhat declining part of the ecosystem. As the games are more and more sold digitally and the store platforms do a lot of the marketing, publisher’s role is diminishing. However, they still typically take 40-70% of the game revenue.

Note that this is an average range. This typically includes publishers fully paying for the game and marketing costs from their own pockets. There are deals where this is not the case and their cut is much smaller.

That leaves the developers with significantly less than the original revenue estimated from selling $60 games. This varies a lot depending on the developer size.

Some developers also publish their own games, saving that loss of revenue.

3. Size of the video game companies

A typical classification of games is whether they were published by a AAA publisher or by indie developers. AA has become a new, also acceptable classification to categorise the inbetweeners.

AAA games – Large budget ($100m+) games with large marketing budgets (another $100m+).

AA games – Produced by professional mid-sized studios, but lack the budget that goes to 100s of millions.

Indie games – Produced as anything from 1 person hobby project to a team of 100 people self-publishing their first big game. Broad definition of the smaller developers and new firms not owned by the industry giants.

4. Segementing by Platform

As mentioned above, games can be made for PC, consoles or mobile. Handheld is another platform that’s recently made a comeback in the face of Nintendo Switch. Arcade used to be a popular, but now mostly forgotten platform for games to be realsed for. VR is the newcomer on the block that hasn’t got a substantial share yet.

The platforms vary a lot by types of games developed for them and will be covered under 6. point.

5. Monetisation models

For the last 20 years, large AAA games have cost $60 to buy. People keep to own a physical or digital copy of the game and that’s it. However, more than ever before, other monetisation methods have started to dominate.

Buy to own – One time purchase of the game.

Subscription – First popularised by the likes of World of Warcraft – people pay a monthly subscription to continue playing (mostly online).

Free to Play (FtP) – Popularised by mobile games. Free to download, monetised in other ways.

In App Purchases – One of the key ways FtP games monetise

Ads – Showing ads to players is the second way some of the FtP, especially hypercasual, games monetise.

Battle-passes – Similar to subscription, but people buy a number of plays instead. For example, they can buy a bundle of 10 matches – allowing them to enter online matches 10 times. Less popular as a monetisation metric.

Cloud platforms – Platforms like Game Pass can offer developers a wide range of monetisation options from money upfront to pay per play. On top of that, in app purchases are viable complementary revenue source.

6. Genre of the game

Genres can vary from the general 6-8 inclusing Action, Adventure etc to tens of subgenres like rougelike and grand strategy. Video Game Insights’s Steam Analytics platform allows you to see and filter by a variety of genres and sub-genres.

7. Type of player

There are actually several ways to categorise a player, but ultimately it all comes down to spend. For games relying on in app purchases, only a handful of players can make up majority of their revenue.

According to Swrve, only c. 2.2% of the players ever pay anything and up to 46% of the revenue comes from 0.22% of the player base. Clearly, identifying the top payers is key.

Types of players are also important for other business models – keeping fans engaged increases the likelyhood of them purchasing sequals or other games developed by the same developer.

Player analytics has reached huge complexity and there are whole analytics teams dealing with terabytes of player data to figure out how to best monetise each player type.

8. Other segments

There are other ways to segment the games that are less to do with market research and more about product management and competitor research.

It’s important to know which other games fit the same theme, art style etc. This allows game developers to understand what works and doesn’t in their space as well as how to better estimate revenue potentials.

Where to find video game market trends, data and analytics?

Mobile games industry is spoiled with choice when it comes to data. Platforms like Appannie are expensive, but provide extensive and high quality data.

It’s a lot harder to access high quality information on PC and consule markets. Below summarises some of the options available.

Newzoo

Newzoo is the leading global games industry data platform. It’s expensive, but great for market size, eSports and much more. Widely used by large game studios.

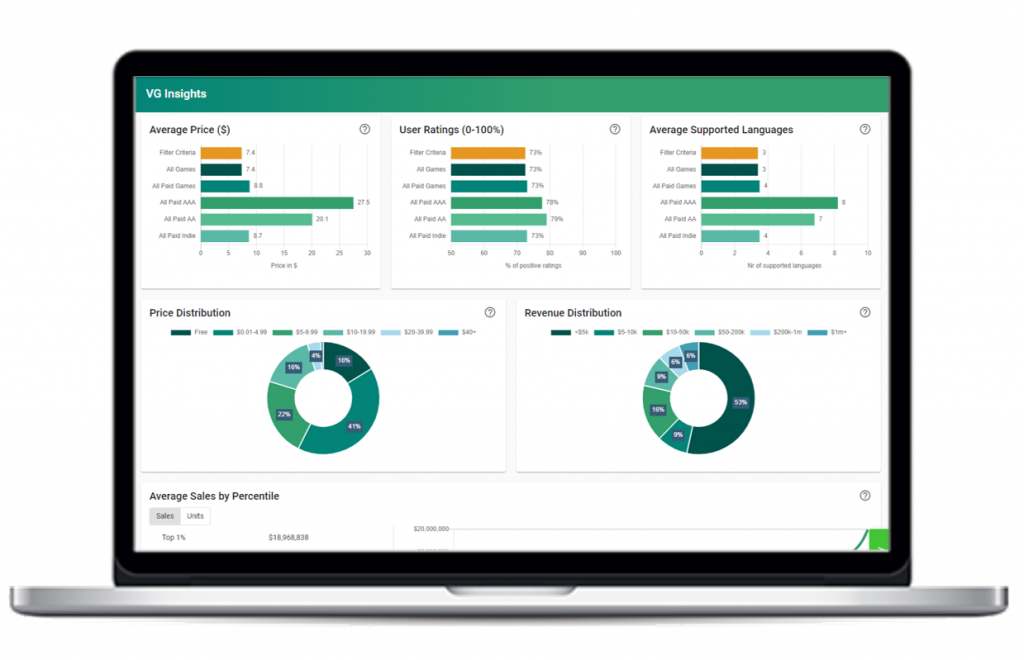

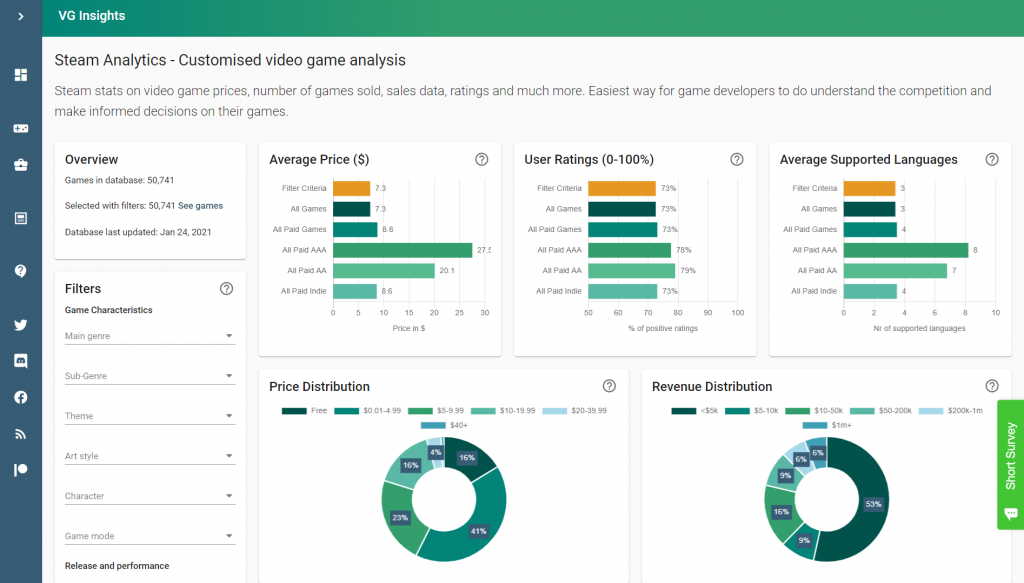

Video Game Insights

Video Game Insights was created to provide a mostly free and generally cheaper high quality alternative to existing solutions.

Steam Analytics platform allows indie developers, enthusiasts and large studios alike to quickly understand how the Steam game market is evolving.

Top charts show which games are the best selling, most played or have the most hype around the upcoming launch.

It is excellent for market and competitor research. It is also a great tool for quick back of the envelope revenue estimates for a game idea.

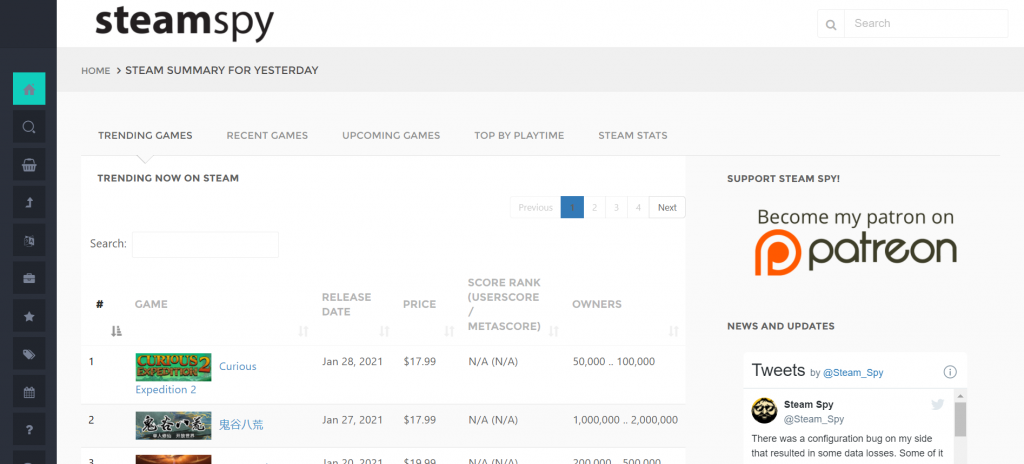

Steamspy

Steamspy has long been the go to free / cheap source of PC games data. It offers a large amount of data on Steam games, but doesn’t package it into a convenient format for market / competitor analysis.

Other video game data sources

There are other video game industry data providers out there from GSD to SteamDB, each with their own strengths and weakenesses.

On top of that, there are some sites doing an incredible job covering Twitch straming statistics such as Twitchtracker and SullyGnome.

Final takeaways

Games industry is a huge and complex ecosystem and there’s a tool or data source out there for each specific need.

Video Game Insights covers a range of articles from tutorials on how to do market and customer analysis to tips on video game marketing and pricing.

If you found this insightful, you might want to check out more games industry trends on our free Steam Analytics platform!